Invoicing for 1099 Vendor/Supplier

All regions are encouraged to participate in the 1099 Compliance Program. The program addresses the issue of any non-compliance with federal tax filing requirements for Form 1099-MISC. The IRS requires 1099’s to be sent annually to independent contractors. Typically, a section, area or region may hire independent contract vendors to provide various services throughout the year.

Additional information can be found at the 1099 Compliance Program.

How to create an Invoice

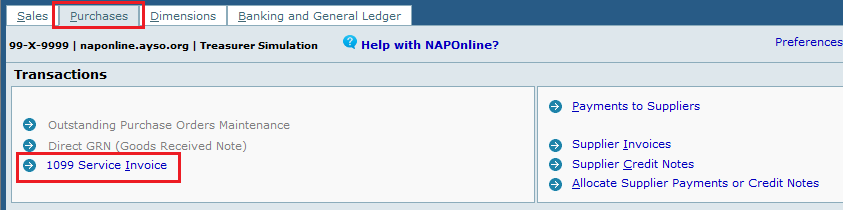

- Create a Supplier. Once you have set up your supplier in the Purchases Tab choose 1099 Service invoice

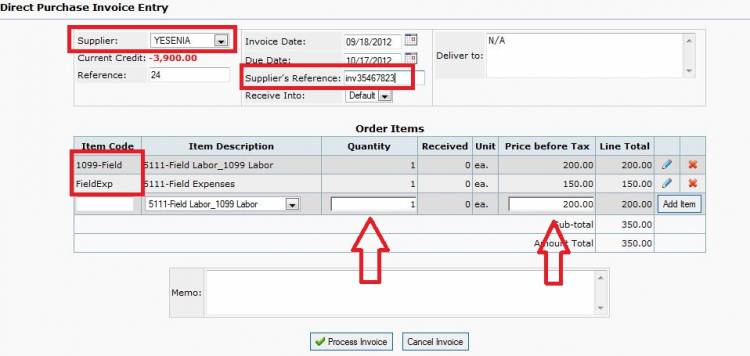

- Choose the correct Supplier

- You must enter the Supplier's Reference number.

- Enter an Item Code from the Category 1099 Service

- Enter Quantity is each item or Player. (The price will be multiplied by this amount)

- Enter the Price before tax amount (Registration Fee)

- Below is an example of a Vendor who painted the fields. They have the 1099 Labor but also the Paint Reimbursement, which is not a 1099 Service.

- Click the link to go to the Wiki on How to make a payment